Exam 2 study guide

Firms and markets

You should understand…

- …how demand curves are derived from consumer willingness to pay

- …the difference between fixed costs and variable costs

- …how to calculate total cost, total revenue, average fixed costs, average variable costs, marginal cost, marginal revenue, and maximum profit

- …that maximum profit occurs where marginal revenue is equal to marginal cost ($MR = MC$)

- …that socially optimal quantity occurs when the demand is equal to the marginal cost ($\text{demand} = MC$)

- …how to calculate elasticity of demand ($-\frac{\Delta Q}{\Delta P} \times \frac{P}{Q}$)

- …what elasticity measures and why it is important in public policy and administration

- …how a single demand curve can have an overall elasticity and different elasticities at each point

- …economies of scale, diseconomies of scale, economies of agglomeration, network effects, and the difference between short-run and long-run costs

- …that market equilibria (i.e. optimal price and quantity) occur at the intersection of supply and demand curves

- …how government-imposed price floors and price ceilings distort market-clearing equilibria

- …and be able to identify the differences between changes in supply/demand and changes in quantity supplied/demanded

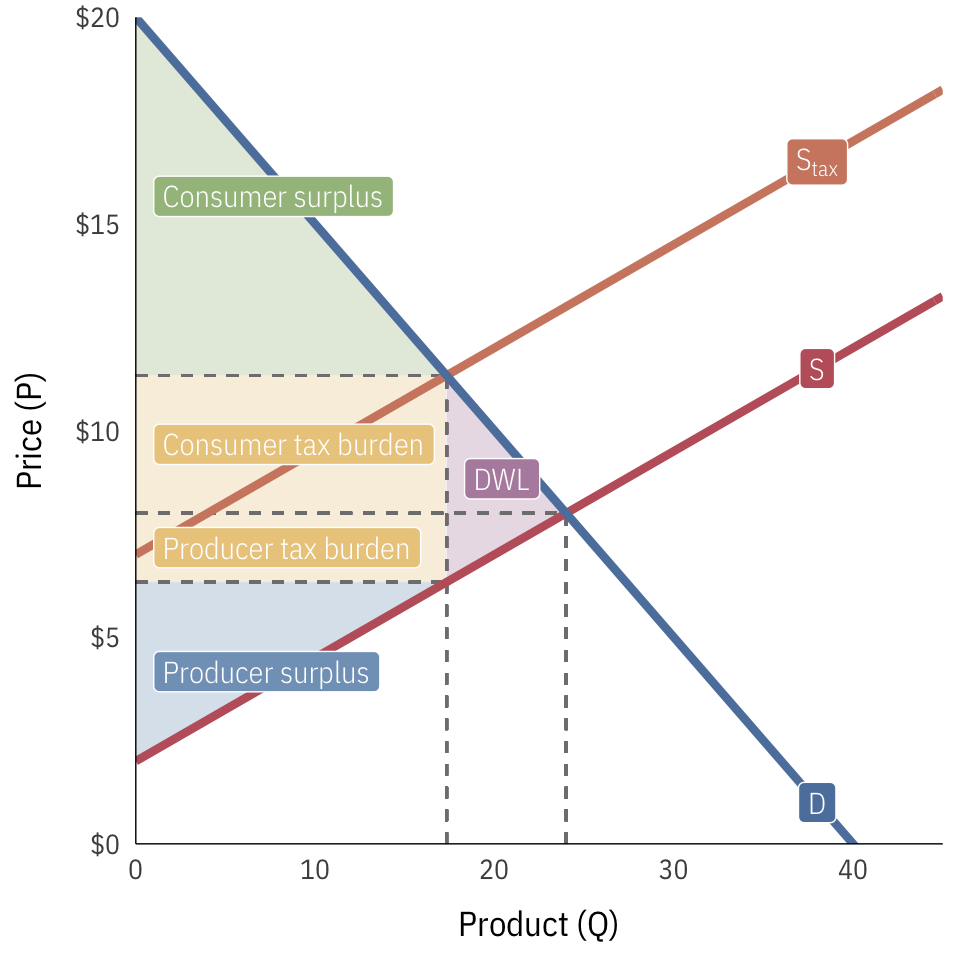

- …what consumer and producer surplus represent

- …the relationship between elasticity of supply and/or demand and the size of consumer and producer surplus

- …how taxes impose deadweight loss on society

- …how the burden of taxes depends on the elasticity of supply and/or demand

- …why governments tax and the philosophical and ethical principles behind who should bear the burden of taxes

- …the difference between price-taking and price-making

- …how firms try to gain market power, including monopolies, branding, cost controls, regulation, and switching costs

- …why firms try to gain market power

- …why firms want to price discriminate

- …the consequences of monopolistic production (lower Q and higher P than what would happen under perfect competition; deadweight loss)

- …how governments can regulate monopolies

- …why natural monopolies exist and how governments can induce them to produce at socially optimal levels

- …how firms need to be somewhat anti-competitive and anti-capitalist in order to maximize profits, innovate, and (essentially) be more competitive and capitalist

Guides

Important formulas:

-

Demand:

$$ P = aQ + b $$

-

Total cost:

$$ \begin{aligned} TC = TFC + TVC \\

\text{or a formula using } Q \text{, like} \\

TC = aQ^2 + b \end{aligned} $$ -

Average cost:

$$ AC = \frac{TC}{Q} $$

-

Marginal cost:

$$ \begin{aligned} MC &= \frac{\Delta TC}{\Delta Q} \\

&\text{or} \\

MC &= \text{First derivative of TC} \\

&= 2aQ \text{ (if } TC = aQ^2 + b) \end{aligned} $$ -

Total revenue:

$$ \begin{aligned} TR &= PQ \\

&\text{or} \\

TR &= (aQ + b)Q \\

&= aQ^2 + bQ \end{aligned} $$ -

Average revenue:

$$ AR = \frac{TR}{Q} $$

-

Marginal revenue:

$$ \begin{aligned} MR &= \frac{\Delta TR}{\Delta Q} \\

&\text{or} \\

MR &= \text{First derivative of TR} \\

&= 2aQ + b \text{ (if } TR = aQ^2 + bQ) \end{aligned} $$ -

Maximum profit:

$$ max(\pi): MC = MR $$

-

Price elasticity of demand (see this guide of how to get to

\(- \frac{\Delta Q}{\Delta P} \times \frac{P}{Q}\)):$$ \varepsilon = -\frac{\% \text{ change in quantity demand}}{\% \text{ change in price}} = - \frac{\Delta Q}{\Delta P} \times \frac{P}{Q} $$

Important graphs:

-

Consumer surplus, producer surplus, tax revenues, tax burdens, and deadweight loss (use algebra and geometry to figure out the areas of the triangles ($\frac{1}{2} \times b \times h$) and rectangles ($l \times w$)):

Helpful resources:

- Derivatives of Exponential Functions (how to calculate derivatives quickly)

- Jason Welker, “Natural Monopoly and the Need for Government Regulation”

Institutions, power, and inequality

You should understand…

- …why institutions matter for public administration, policy, and governance

- …the strengths and weaknesses of and the and general differences between three main theoretical approaches to institutions: institutions as rational behavior, institutions as constraints, and institutions as temporary equilibria

- …the difference between informal and formal institutions

- …why informal institutions exert influence over our actions even if they’re not officially codified

- …the difference between self-enforcing, self-reinforcing, and self-undermining institutions

- …the role of path dependency in the emergence of institutions

Market and government failures

You should understand…

- …the difference between private goods, club goods, common pool resources, and public goods (and how they can be classified as (non)rivalrous and (non)excludable)

- …what a market failure is

- …what a government failure is

- …what public goods are and how governments, the private sector, and informal institutions can address them

- …what common pool resources (CPRs) are and how governments, the private sector, and informal institutions can address them

- …the difference between social and private marginal cost (supply) and marginal benefit (demand)

- …what externalities are and how governments, the private sector, and informal institutions can address them

- …what Coasian bargaining is, when it is advantageous, and why it sometimes fails

- …how cap and trade systems can fix externalities (and when they can’t)

- …how Pigouvian taxes can fix externalities (and when they can’t)

- …how regulation can fix externalities (and when and why it can’t)

- …the difference between income and assets

- …why shared national identity and strong horizontal networks of institutions are important for a country’s social and economic wellbeing

- …how inequitable public policies lead to decreased public goods provision, unequal institutional access, and increased ethnofractionalization

- …why slavery and white supremacy have had lasting institutional impacts on the economic system of today and how government policies have contributed to these consequences (specifically in housing and education)